VAT Calculator Calculate VAT inclusive/exclusive amounts with preset rates for popular countries.

VAT Calculator

Calculate VAT inclusive/exclusive amounts with preset rates for popular countries.

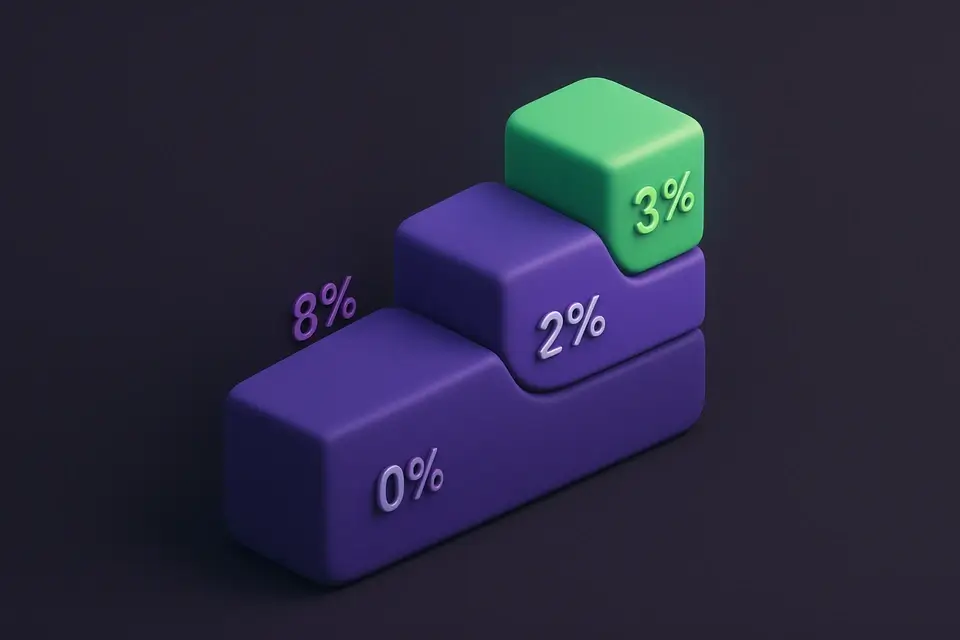

Choose Mode

Select "Add VAT" or "Remove VAT" depending on your starting amount.

Enter Amount & Rate

Input the amount and select a country-specific VAT rate or enter a custom rate.

View Breakdown

See net amount, VAT amount, and gross amount.

What Is VAT Calculator?

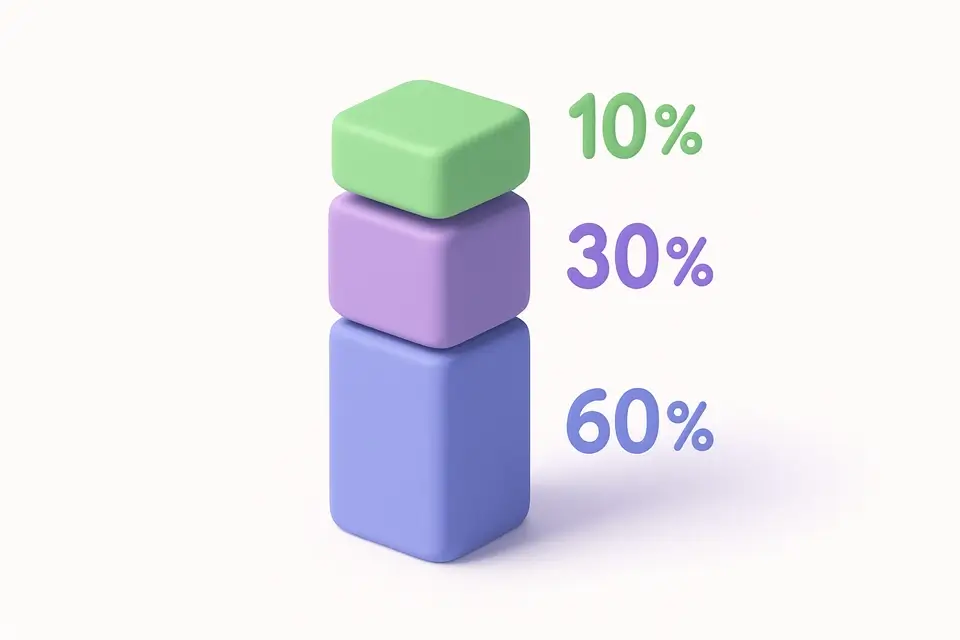

A VAT (Value Added Tax) calculator computes the tax amount when adding VAT to a net (exclusive) price or extracting VAT from a gross (inclusive) price. VAT is used in over 160 countries as the primary consumption tax, including all EU member states, the UK, Canada (GST), Australia (GST), India (GST), and Japan. Unlike sales tax, which is applied only at the final sale, VAT is collected at each stage of the supply chain. This calculator includes preset rates for major countries, making it quick to calculate VAT for international transactions, invoicing, and pricing. It shows the net amount (excl. VAT), VAT amount, and gross amount (incl. VAT) with the formula used.

Why Use VAT Calculator?

-

Preset VAT/GST rates for 10+ countries

-

Add VAT or extract VAT with one click

-

Shows net, VAT, and gross amounts clearly

-

Essential for international business invoicing

-

Custom rate input for any jurisdiction

Common Use Cases

International Invoicing

Calculate correct VAT amounts when invoicing customers in different countries.

Import/Export

Determine VAT obligations when buying or selling goods internationally.

Price Setting

Set VAT-inclusive prices that result in clean round numbers.

Expense Reports

Extract VAT from receipts for tax reclamation purposes.

Technical Guide

VAT calculations use the same mathematics as sales tax: Add VAT: Gross = Net × (1 + Rate/100), VAT = Net × Rate/100. Remove VAT: Net = Gross / (1 + Rate/100), VAT = Gross − Net. The distinction from sales tax is administrative, not mathematical. VAT is charged at every stage of the supply chain, but businesses reclaim VAT paid on inputs (input tax credit). The net effect is equivalent to a tax on the final consumer only. Standard VAT rates vary: UK 20%, Germany 19%, France 20%, Italy 22%, Japan 10%, India 18% (standard GST), Canada 5% (federal GST). Many countries have reduced rates for essentials and zero rates for exports.

Tips & Best Practices

-

1Standard VAT rates: UK 20%, Germany 19%, France 20%, Japan 10%

-

2Many countries have reduced VAT rates for essentials (food, books)

-

3Exports are typically zero-rated for VAT purposes

-

4Businesses can usually reclaim VAT paid on business purchases

-

5When quoting prices internationally, specify whether VAT is included

Related Tools

Profit Margin Calculator

Calculate gross margin, net margin, and markup percentage from revenue and costs.

🔢 Math & Calculators

Discount Calculator

Calculate discount amount and final price from percentage or fixed discounts.

🔢 Math & Calculators

Sales Tax Calculator

Calculate sales tax amount and total price, or extract tax from a tax-inclusive amount.

🔢 Math & Calculators

Currency Converter

Convert between 30+ world currencies with approximate exchange rates.

🔢 Math & CalculatorsFrequently Asked Questions

Q What is VAT?

Q How is VAT different from sales tax?

Q What is the difference between net and gross?

Q Can I reclaim VAT?

Q What is GST?

About This Tool

VAT Calculator is a free online tool by FreeToolkit.ai. All processing happens directly in your browser — your data never leaves your device. No registration or installation required.